Back to List

“Income Lab’s Life Hub tool is a welcome innovation, helping financial advisors to build more realistic and adaptable financial plans for their clients,” said Derek Tharp, Ph.D., CFP®, assistant professor of finance at Southern Maine University, lead researcher at Kitces, and a senior advisor to Income Lab. “Better tools for advisors lead to more clarity and security for clients, showing how their retirement plans can weather different scenarios”.

It’s official, Life Hub is here!

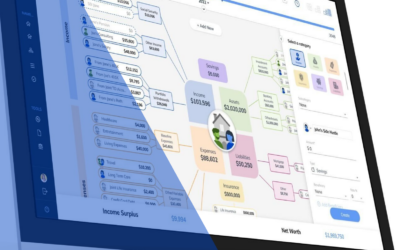

Key features of Income Lab’s new Life Hub tool:

- Timeline – Navigate through future years and explore financial projections

based on the client’s Income Lab retirement income plan - Tax Sourcing – Gain clarity into how best to source portfolio withdrawals

and implement tax-smart distribution planning - Integrations – Reduce or eliminate duplicate data entry and quickly update account balances through integrations with Riskalyze, Redtail, Charles Schwab, TD Ameritrade, Fidelity, and others

- Easy Edit – Update financial data and make plan changes and then interactively explore how these adjustments would affect a client’s retirement plan

- One Page – Share a printable, exportable one-page PDF report

- Milestones – Show precisely when a client will reach a significant financial event, such as paying off a mortgage or filing for social security