The results and key findings of the annual technology survey and report, produced by Joel Bruckenstein of T3 Technology Tools for Today and Bob Veres of Inside Information, were presented live at the recent 20 Anniversary T3 Advisor Conference, which took place January 22-25 in Las Vegas. The survey was taken by nearly 3,000 participants and covered 40 different categories.

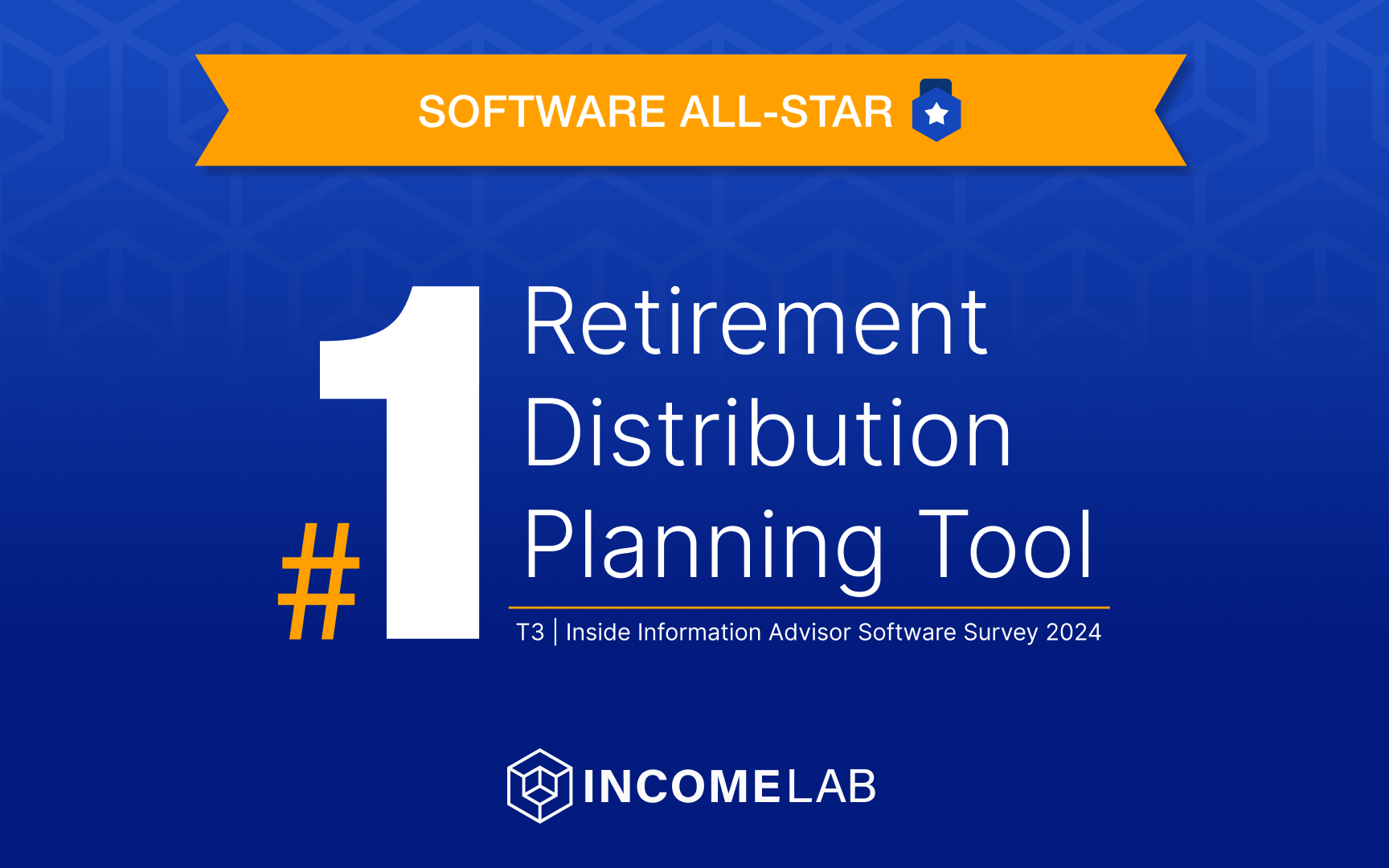

“Given the rate of growth these past two years, we could see the [the Retirement Distribution] category raise its profile in coming surveys,” the report summary states. The report also mentions that it didn’t take Income Lab and other newcomers very long to “rocket to the top of the category”. Category newcomers accounted for nearly all of the growth in aggregate market penetration for this software category in recent years.

“We’re very excited to be ranked the #1 Retirement Distribution Planning Tool in market share and, more importantly, that our users have rated us very highly, putting us in the All-Star category with other best-in-class technology providers,” said Johnny Poulsen, Co-Founder and CEO of Income Lab.

According to a report from the Alliance for Lifetime Income, 2024 will be a record-breaking year for retirement in the U.S., with an average of 11,000 Americans a day expected to celebrate their 65th birthday from now until December. This so-called “silver tsunami” will represent the largest surge of

retirement-age Americans in history. On stage at the T3 conference, Bruckenstein called on advisors to embrace specialized retirement distribution tools more broadly. He noted that the adoption of retirement

distribution tools was currently “worrisomely low”, but “moving in the right direction”, as the category rose from 10.7% market share in 2022 to 15.19% in 2024.

Accessibility of Interactive Financial Planning

Income Lab also announced on the first day of the T3 conference that they were now offering Life Hub as a stand-alone app. Life Hub is a financial planning tool that helps advisors take their clients to and through retirement in a clear and interactive way. The announcement comes on the heels of Income Lab’s recent brand refresh and aligns with its mission of revolutionizing how people navigate retirement so they can live with confidence. The goal of this launch is to make planning clearer and more accessible, not only for advisors but more importantly for the clients they serve.

“We believe every person deserves a Life Hub plan. Advisors tell us that Life Hub helps them clear away the clutter from planning and make it clear how clients can make their financial lives and goals happen,” said Poulsen. Poulsen also shared, “Advisors are faced with changing client needs, and expectations on what planning should look like are trending to be more visual, interactive, and conversational. Clients want to be a part of the process and interact with their plan.”

Income Lab’s next-generation approach to planning has proven to be a game changer for advisors who want to deepen their relationship with their clients and an engaging way to talk with prospects.

To see the full T3 | Inside Information Software Survey results, please click here.