Get started for $20/month for 3 months*.

*After 3 months, standard pricing automatically applies

Tax Lab

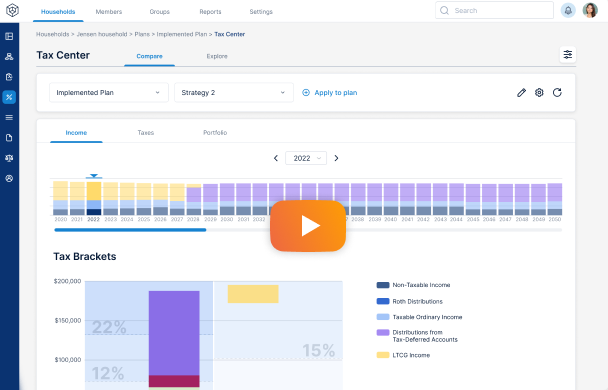

Tax-smart distribution planning at your fingertips

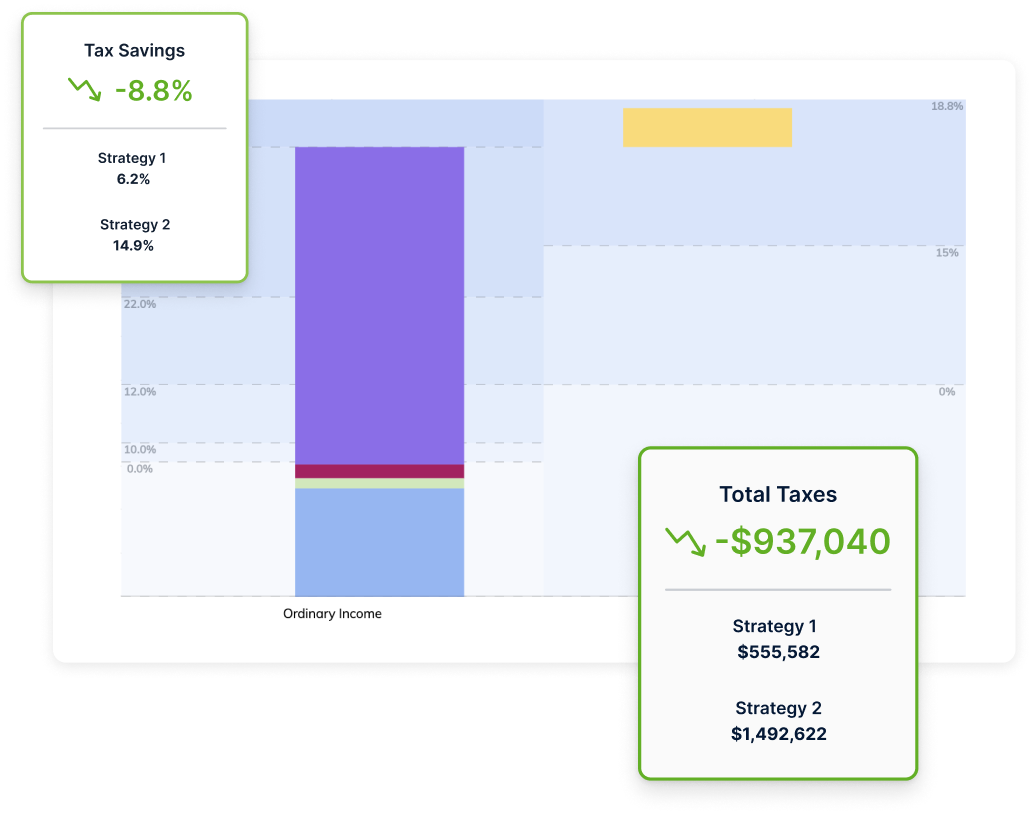

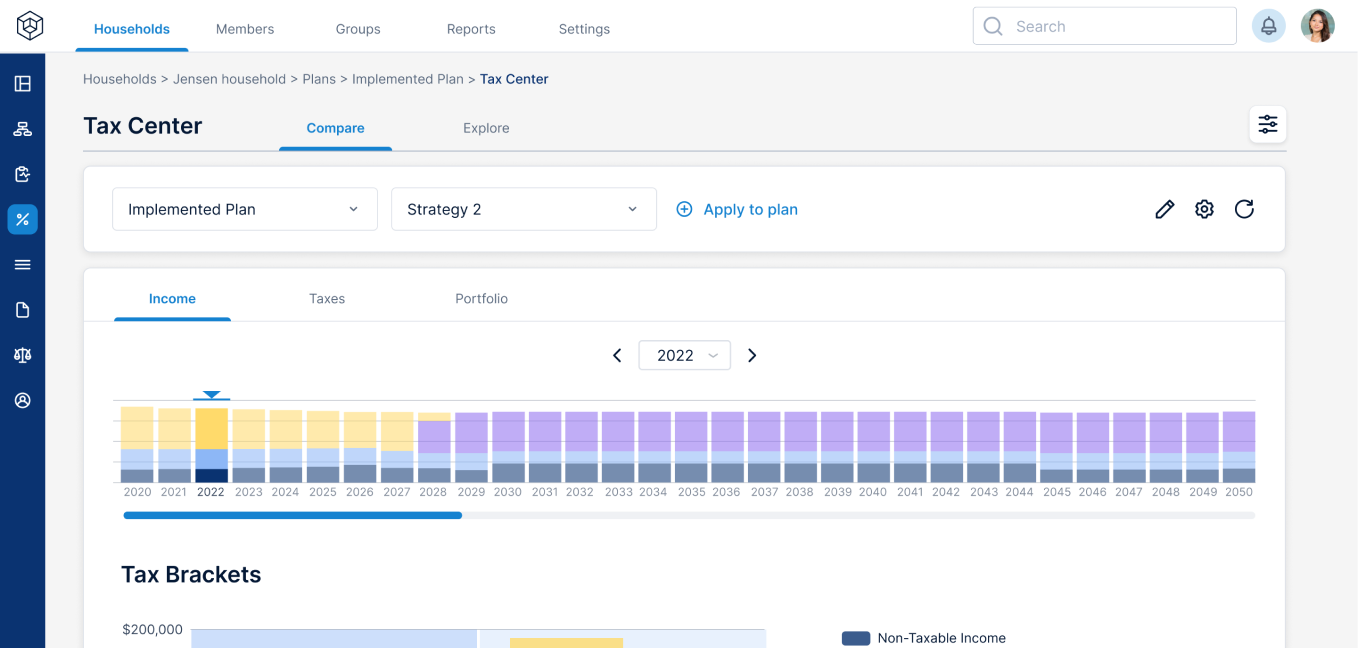

Once you know how much a client can spend, the next questions are, “where should we take distributions from, down to the account level” and “should we consider Roth conversions?”. Income Lab’s Tax Lab helps you answer these questions quickly and estimate the full value of tax-smart distribution planning.

In a recent survey by Herbers & Company, 90% of investors want tax planning assistance.

"Income Lab is the most comprehensive and sophisticated retirement income solution in the current fintech landscape. Not only does it facilitate better, more informed decisions about retirement distribution sufficiency; it also models the various decumulation strategies on an after-tax basis, to help advisors help clients maximize their after-tax retirement income."

Bob Veres

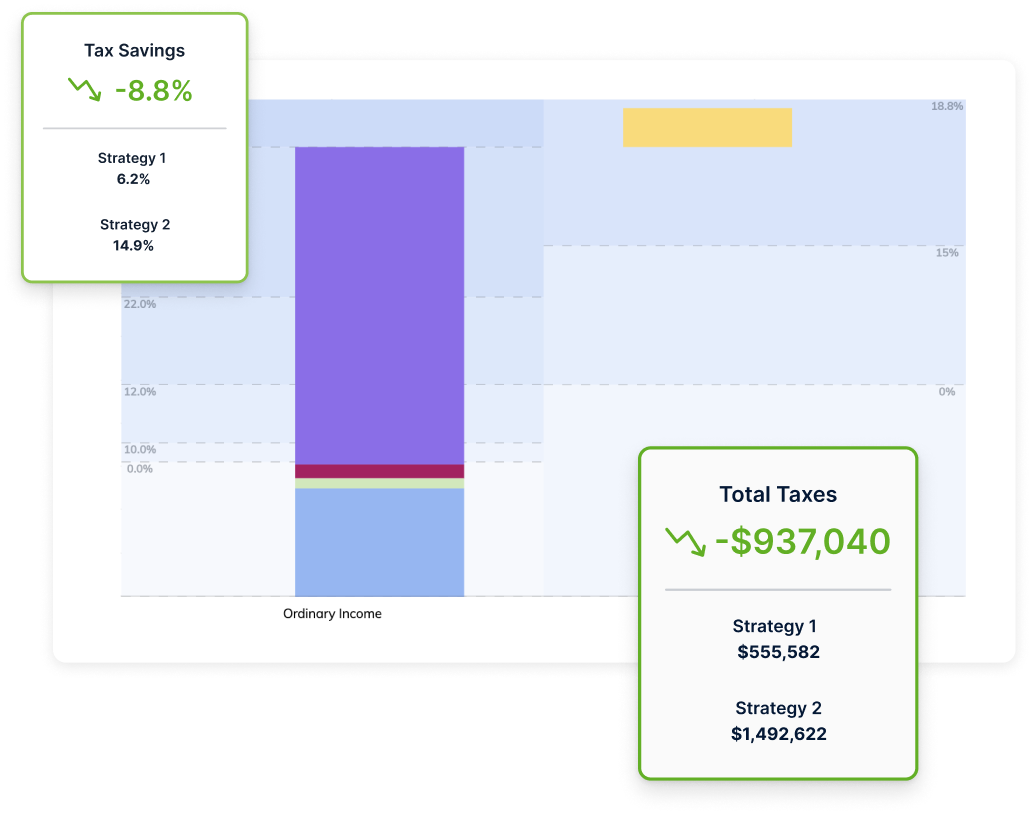

Inside InformationDeciding how best to source portfolio withdrawals involves accounting for a full range of tax effects and a wide range of withdrawal strategies as they apply to each plan. Income Lab helps you quickly evaluate the tax consequences of strategies like Roth conversions, including the complex interactions of different types of income and their differential tax treatment, and produces simple, digestible data to help you and your clients make informed decisions.