Get started for $20/month for 3 months*.

*After 3 months, standard pricing automatically applies

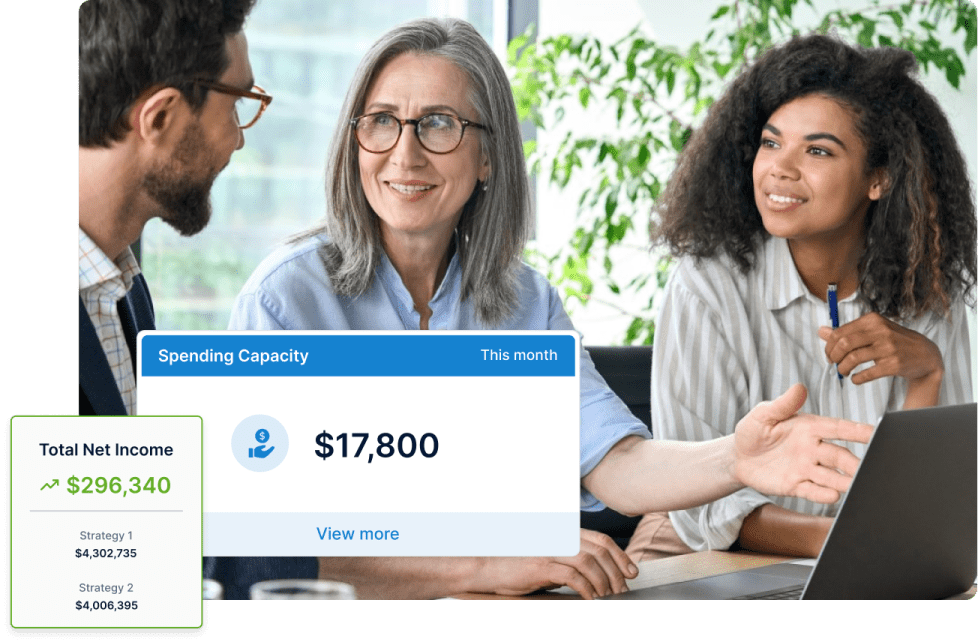

We are committed to providing cutting-edge analytics, from risk analysis to tax-smart distribution planning. But, just as important, our focus is on providing plans and visualizations that are easy to build, easy to explain, and easy to understand. We speak in dollars, not in abstract statistics, helping advisors tell stories that connect with clients on a human level and build confidence.

Supported by Research

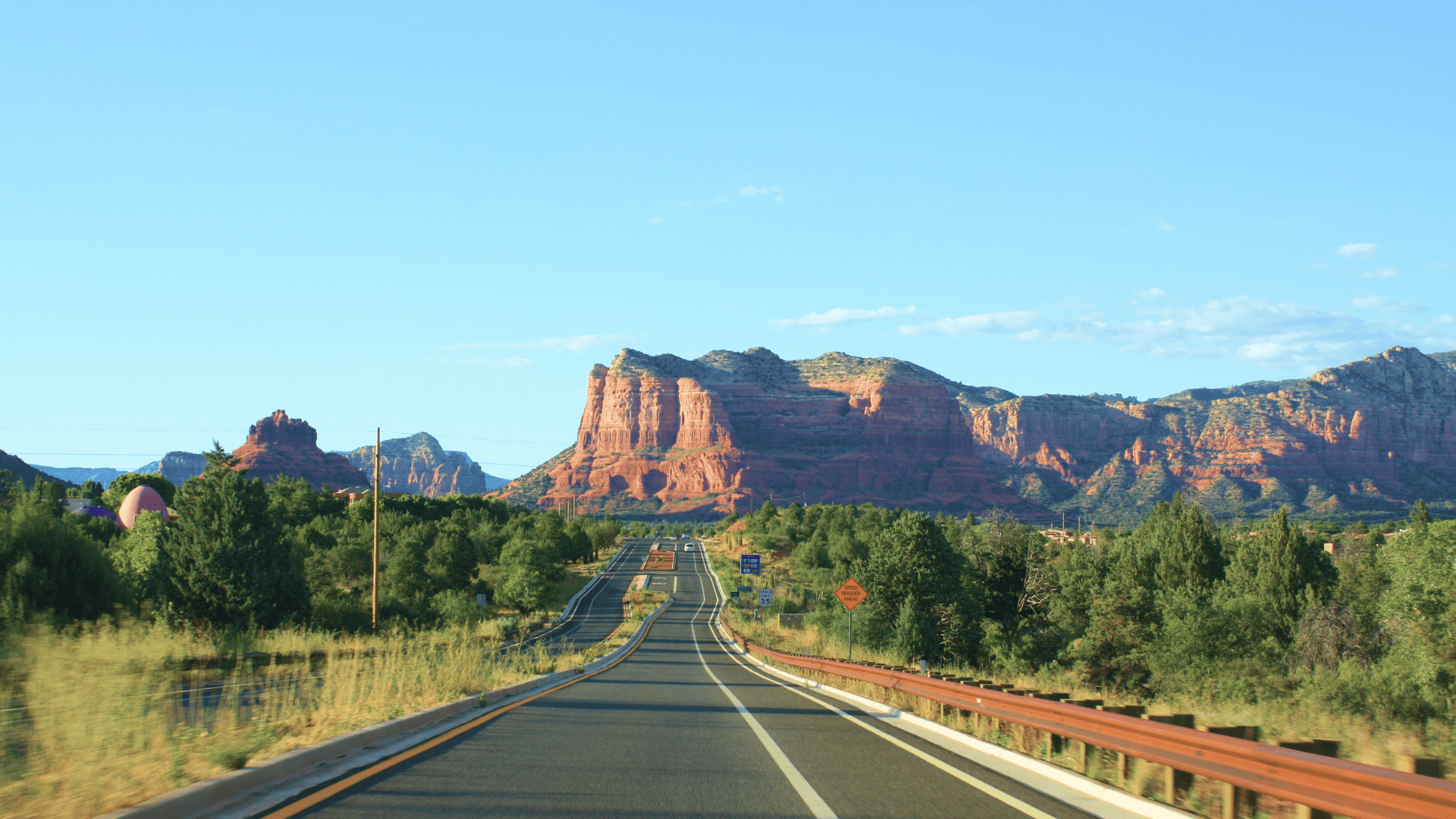

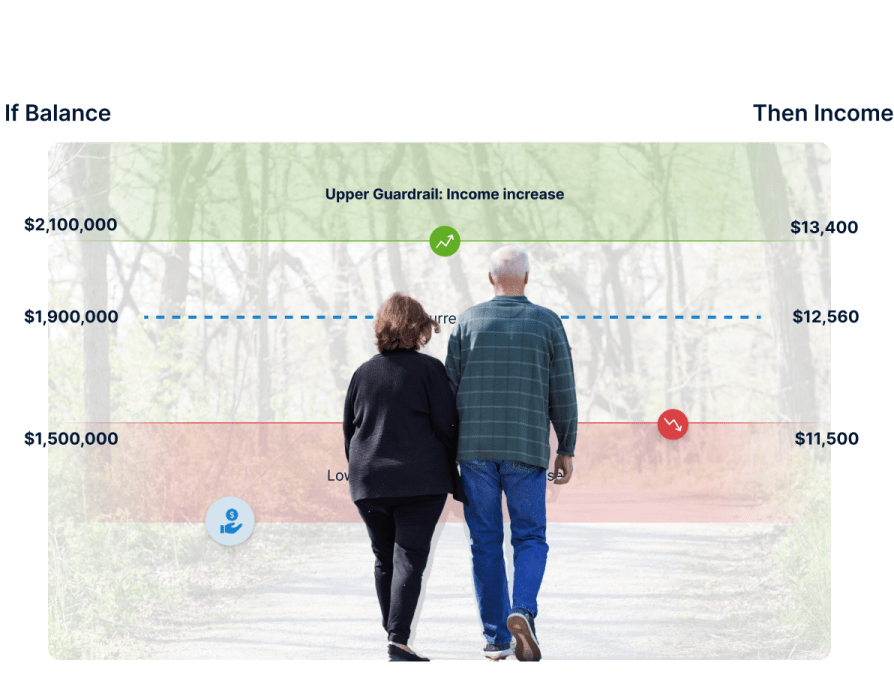

Clients don't fail in retirement – they adjust. The goal of retirement income planning is to give people an opportunity to live their best retirement given their resources, goals, and the world they happen to be living through. We help you advise clients on how much they can spend, what would lead to an adjustment in spending, and what those adjustments could look like.

Supported by Research

Retirement planning should be rooted in how the world really works and the way people really behave. Retirement spending isn't flat – it varies over time. Economic context matters. Inflation is variable and uncertain, not fixed and known. We help you easily build plans that reflect these realities. Every time we replace a simplification with more reality-based methods, the client wins.

Supported by Research

Retirement income planning and management is not a one-time, set-it-and-forget-it event. Change is the only constant, whether that’s changes in account balances, longevity expectations, inflation rates, life events, or goals and preferences. Frequent updates and reanalysis give retirees the best chances of seeing how the landscape is changing and what challenges are coming over the horizon. Whether it is adjusting spending or updating tax-smart distribution plans, retirees benefit from ongoing updates. Income Lab makes those updates easy and scalable.

Read more Read less

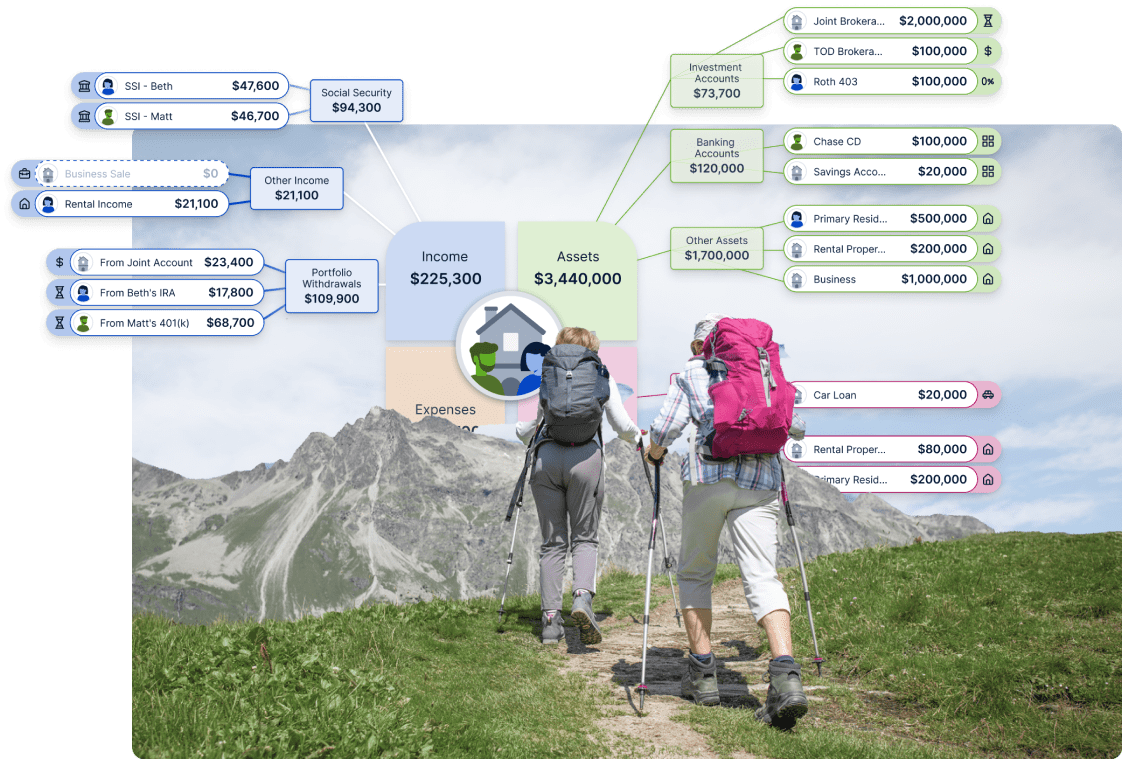

While general ideas make for good headlines, no real person should follow rules of thumb blindly. Each situation has its own idiosyncrasies, special sets of resources, preferences, and goals. So, each plan – whether that's adjustment-based retirement spending plans or tax-smart distribution plans – should be customized to a holistic view of that client's unique situation and risk profile. Income Lab helps advisors capture each client's set of market risks, mortality and longevity risks, and inflation risks and build adjustment-based spending and tax-smart distribution plans that take these risks into account.

Read more Read less

It's important for advisors and clients to understand the environment they are living through and what that might mean for retirement spending decisions. Though the future will likely be different from the past, history is the only actual data anyone has. Income Lab helps you use historical context about how markets and inflation can behave to help clients understand their situation. While history may not repeat itself, it might just rhyme!

Read more Read less

Let computers do what they do best so that humans can do what they do best. Technology should improve your efficiency and provide answers, not more work and questions. We'll never ask you to update values to account for inflation, update plan lengths to account for changes in expected longevity, or ask how much of someone's Social Security will be taxable. We update plans monthly to ensure plans are always up-to-date and advisors know when a plan is calling for an adjustment.

Read more Read less