Start for just $20

— standard pricing applies after 30 days

Social Security Optimizer, Reinvented

Help clients understand the impact of when they claim and why it matters.

* Available as a Stand-Alone or part of the Income Lab Suite.

* Available as a Stand-Alone or part of the Income Lab Suite.

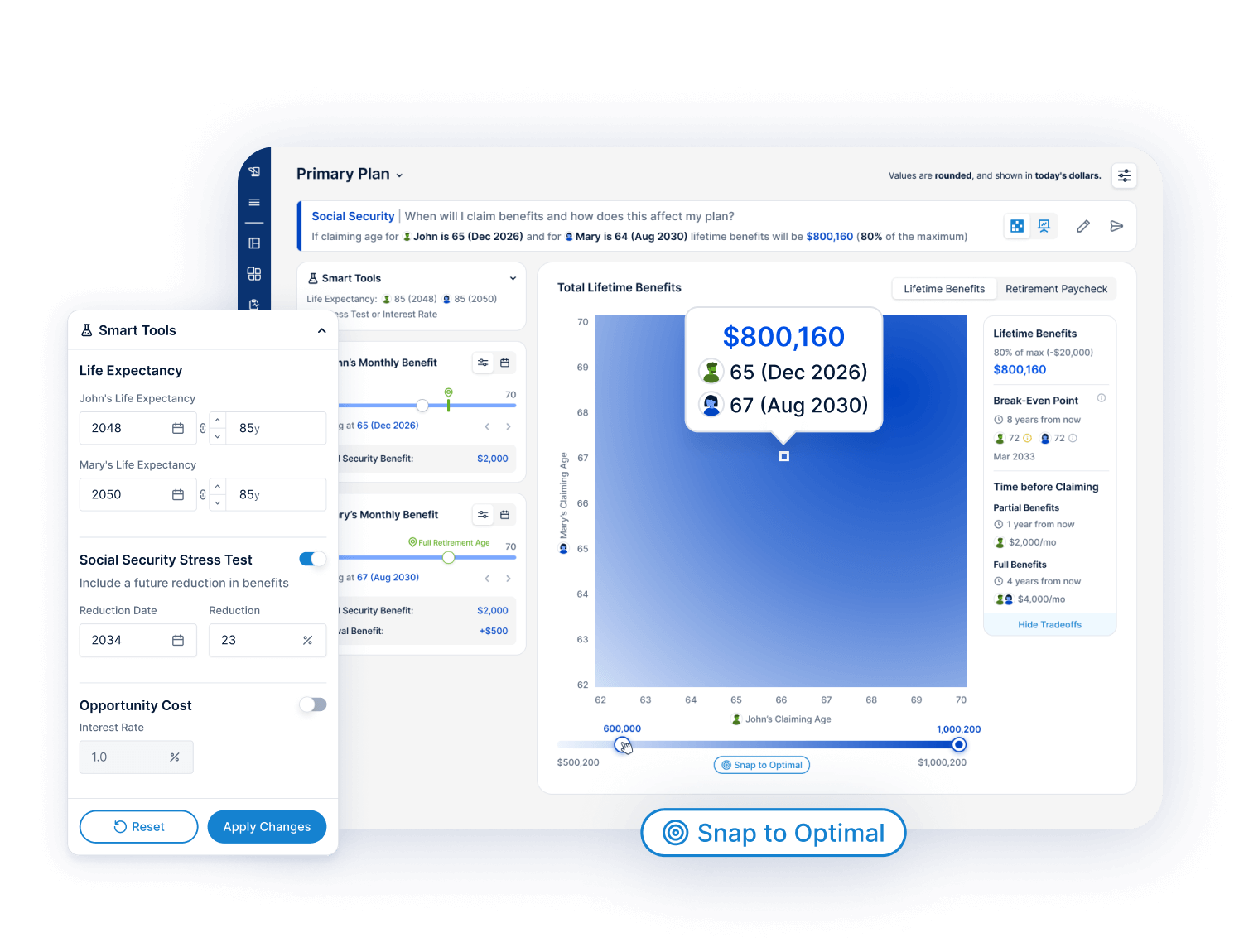

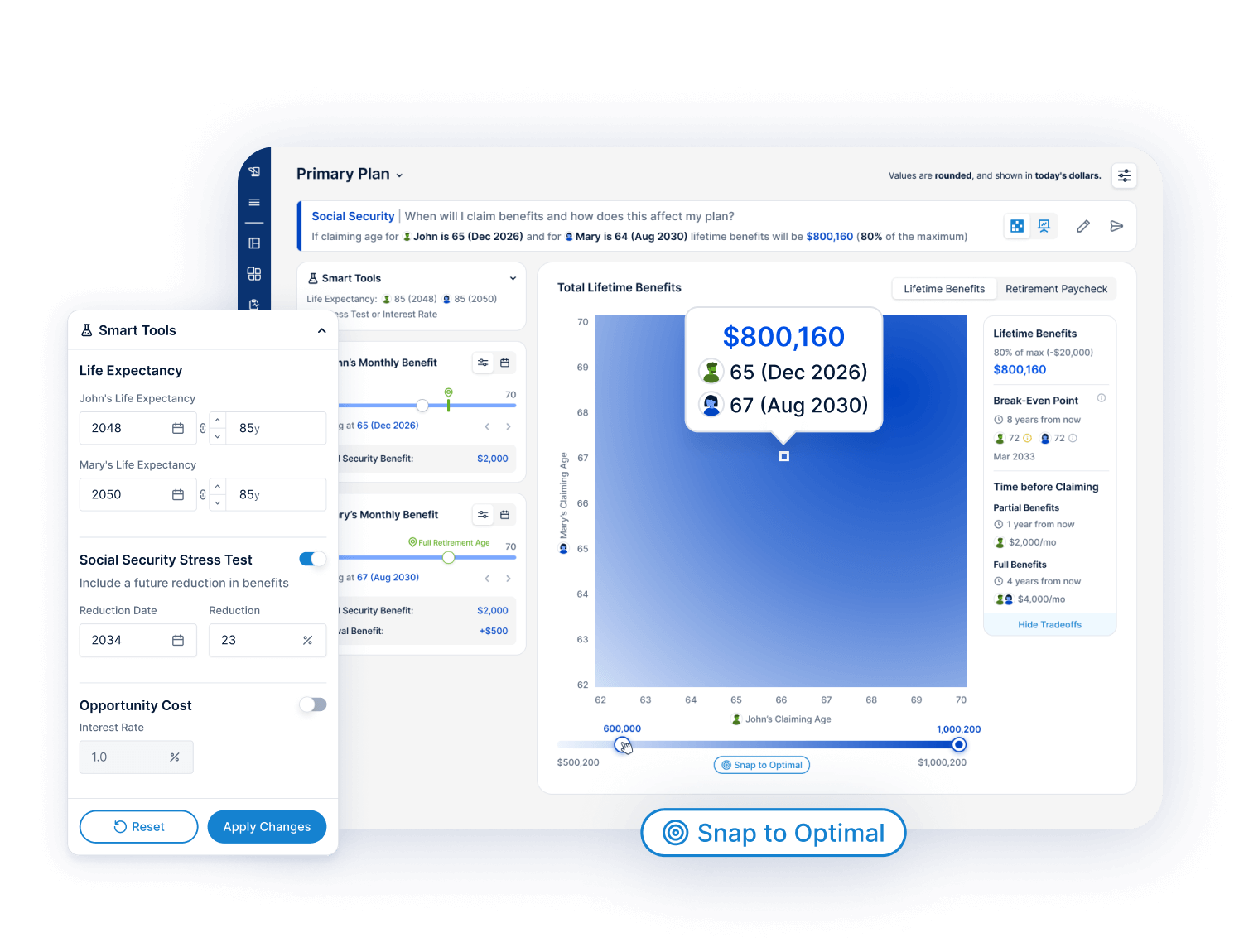

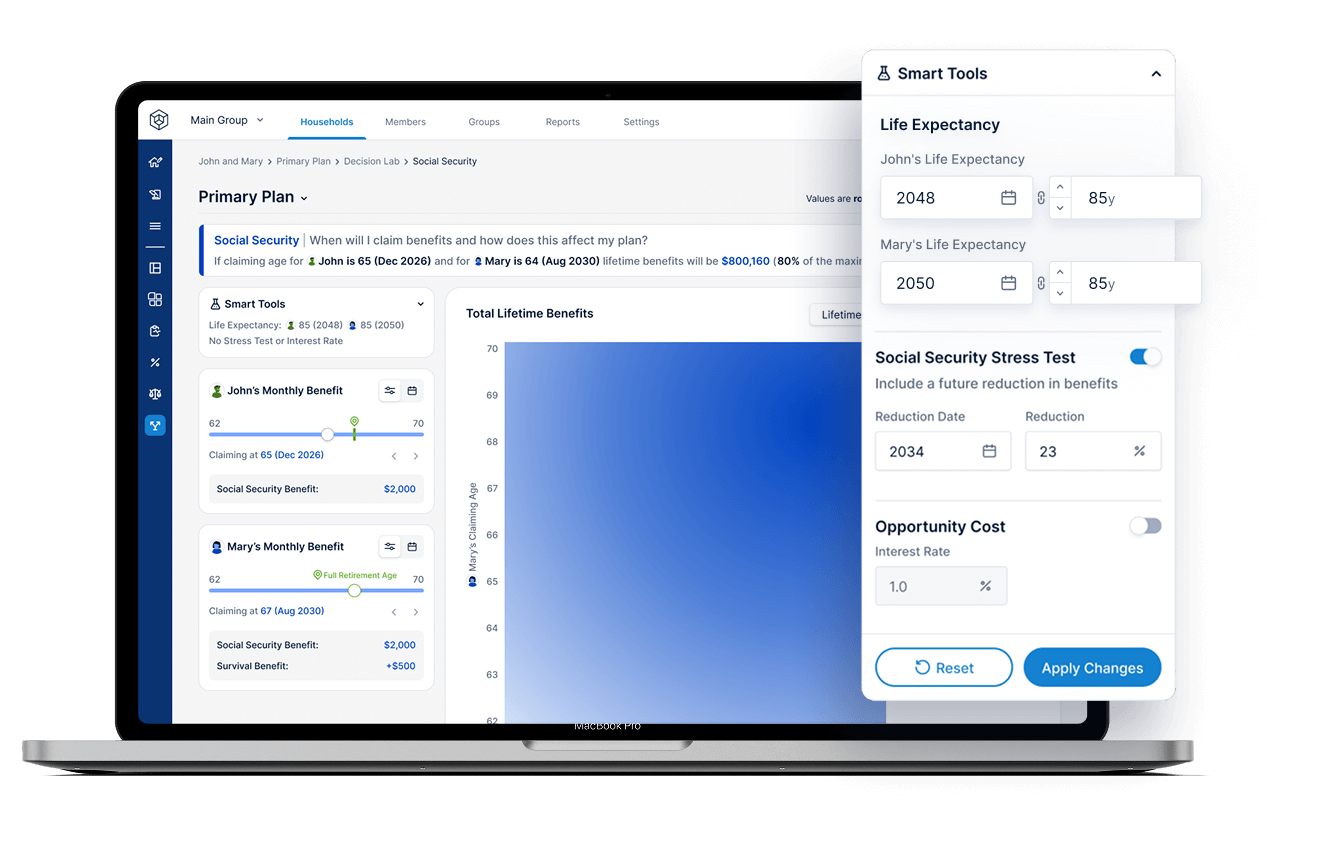

Every client’s retirement plan is unique. A few quick inputs show how the optimal claiming strategy changes based on client risks and preferences. Exploring a range of scenarios with clients can challenge the status quo and show how a custom plan can help them take control and retire on their own terms, with confidence.

Show clients how longevity and mortality risks shape their retirement and model the impact of potential Social Security benefit cuts.

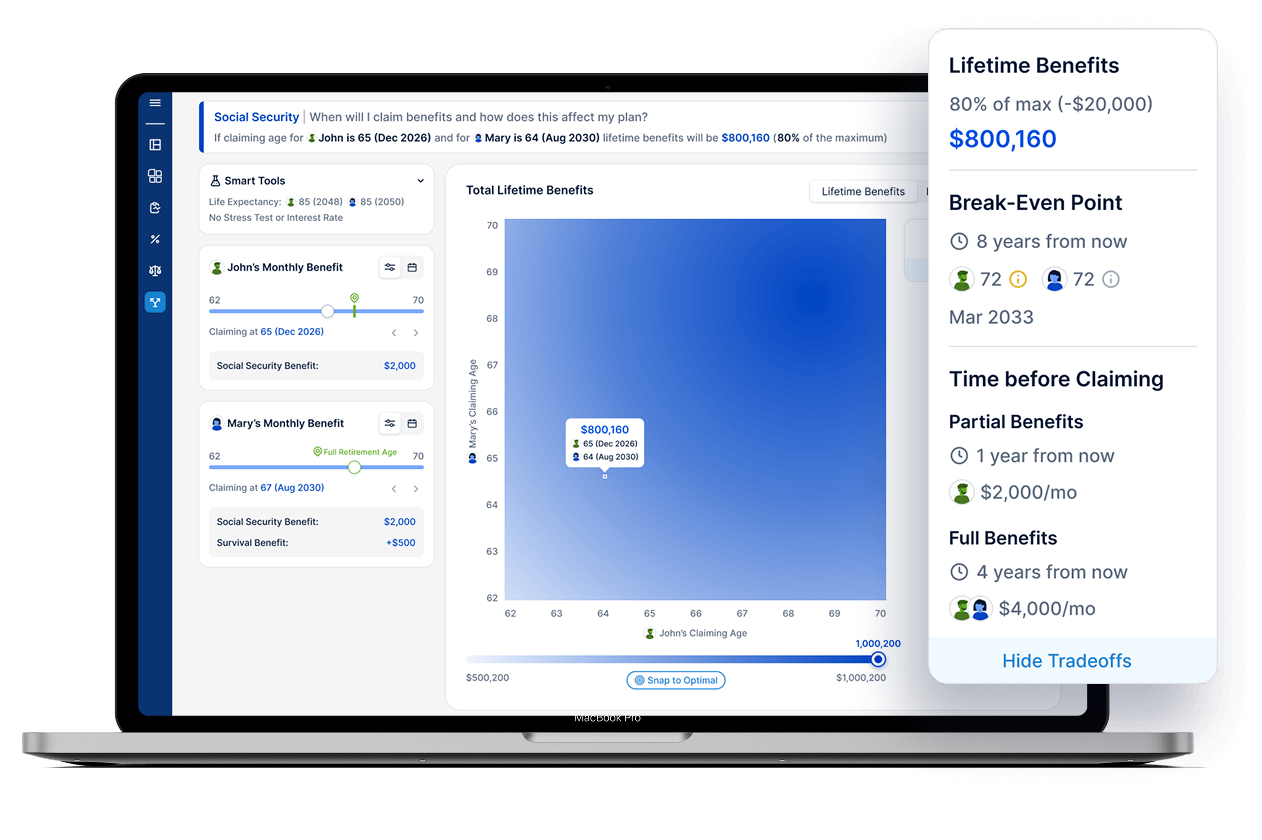

Instantly identify the optimal claiming strategy, and quickly explore how small changes can impact timing and overall outcomes.

Every claiming strategy has trade-offs. Whether clients want to claim early or delay until 70, Income Lab’s social security planning software helps you model the options, clearly showing the impact on income, risk, and lifestyle over time. It’s not about finding the perfect answer. It’s about helping clients choose the path that fits their life.

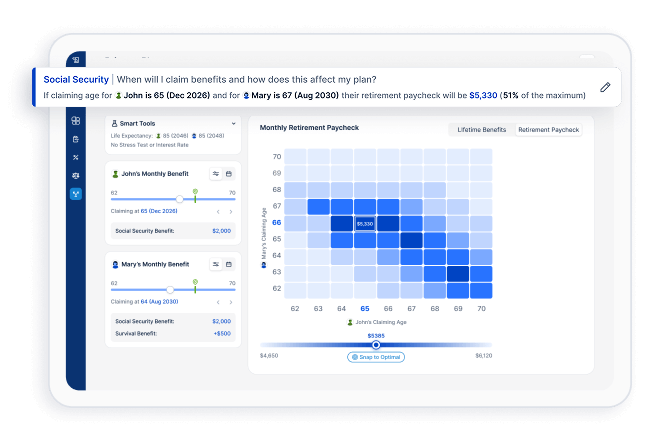

See how claiming impacts your client’s retirement paycheck. Optimizing benefits goes beyond Social Security—claiming strategies affect spending power and overall plan risk.

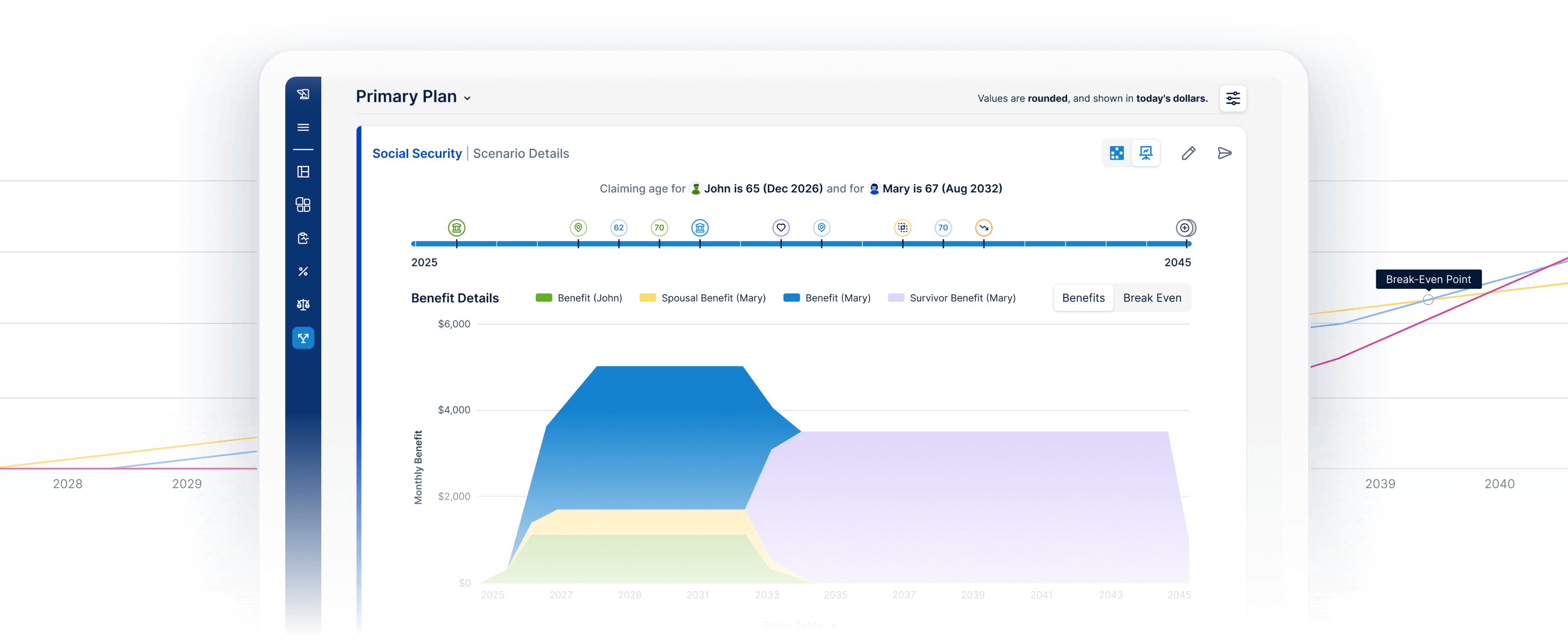

Social Security decisions don't happen in a vacuum. See how different claiming strategies affect the rest of the plan, including portfolio balances and withdrawals, and compare options side by side.

Help clients build a Social Security plan they not only understand but feel good about. With Income Lab’s Scenario Details view, you can clearly show how a strategy works over time. Use the interactive timeline to visualize income streams, benefit changes, and key milestones across the full retirement journey. That clarity turns uncertainty into confidence, and “What if?” into “Here’s the plan.”

We make it easy to see how different longevity assumptions impact the optimal strategy, bringing clarity and confidence to claiming decisions.

See how future benefit cuts could influence your claiming strategies with ease.

We take Social Security planning beyond the basics by showing how a strategy impacts the entire plan, how much clients can spend overall and the risks they face in retirement.

We help advisors provide better advice by allowing them to model custom scenarios and take seriously client concerns, and many clients’ preferences to start receiving benefits sooner.

Explore Longevity and Mortality Risk

Explore Longevity and Mortality Risk

We make it easy to see how different longevity assumptions impact the optimal strategy, bringing clarity and confidence to claiming decisions.

Explore Benefit Cuts

Explore Benefit Cuts

See how future benefit cuts could influence your claiming strategies with ease.

Evaluate Plans Holistically

Evaluate Plans Holistically

We take Social Security planning beyond the basics by showing how a strategy impacts the entire plan, how much clients can spend overall and the risks they face in retirement.

Support Client Preferences

Support Client Preferences

We help advisors provide better advice by allowing them to model custom scenarios and take seriously client concerns, and many clients’ preferences to start receiving benefits sooner.

Income Lab’s Social Security Optimizer transforms complex claiming choices into clear, visual plans. Quickly compare strategies, explore trade-offs, and show clients how their benefits evolve over time—turning uncertainty into confidence.