Get started for ONLY $20!*

*After 30 days, standard pricing automatically applies.

Powerful Annuity Planning Software

Your clients deserve a plan that reflects all aspects of their financial life.

Modeling how guaranteed income from an annuity can affect a retirement plan is key to making good decisions and providing great retirement income advice. At Income Lab, annuities can be modeled realistically in your clients' retirement income plans, reflecting how annuity balances and income streams affect how much clients can spend and their retirement income guardrails.

It can be hard to know how an annuity actually works. But with Income Lab, you can conduct annuities stress tests under different return scenarios and gain the clarity you need to give better advice.

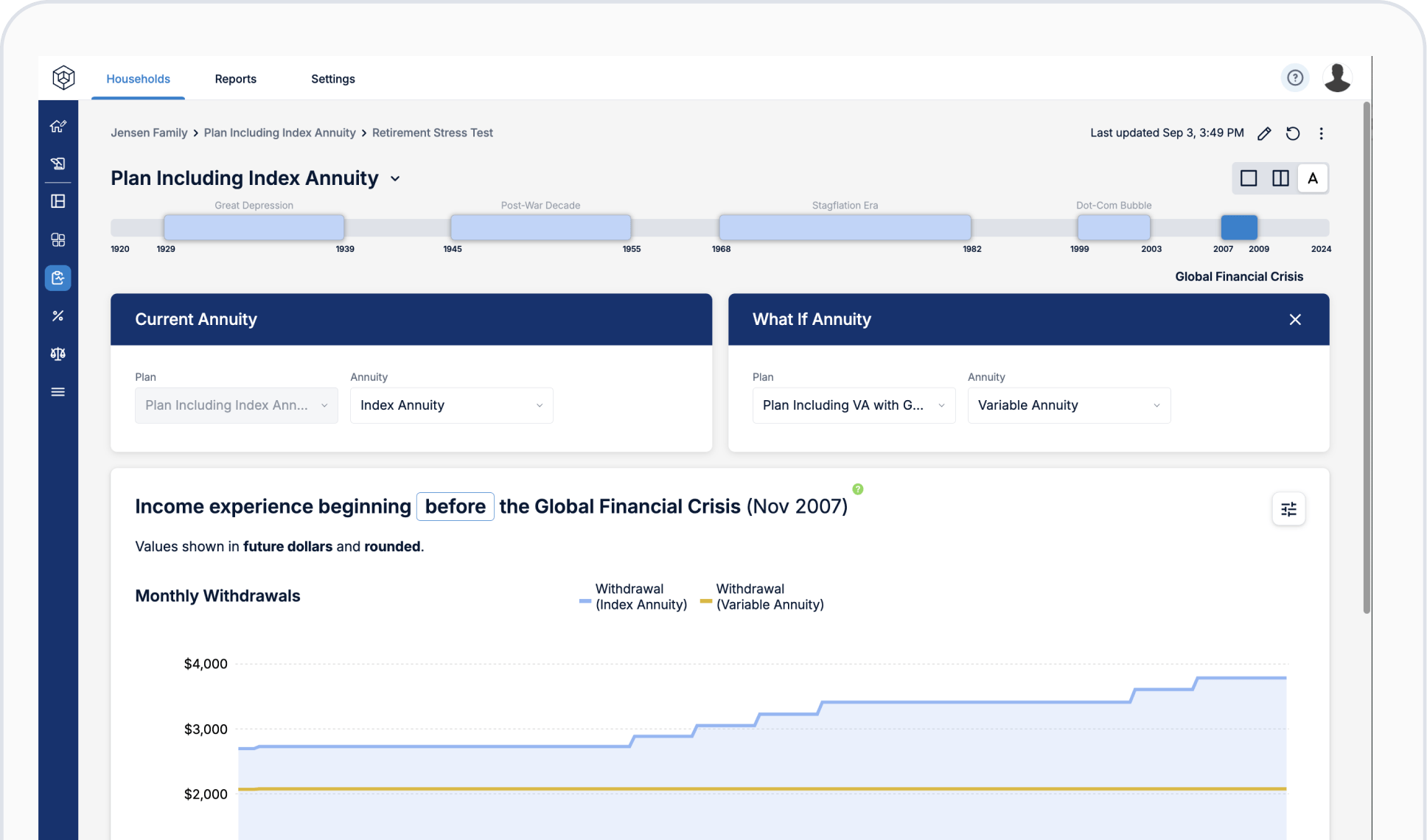

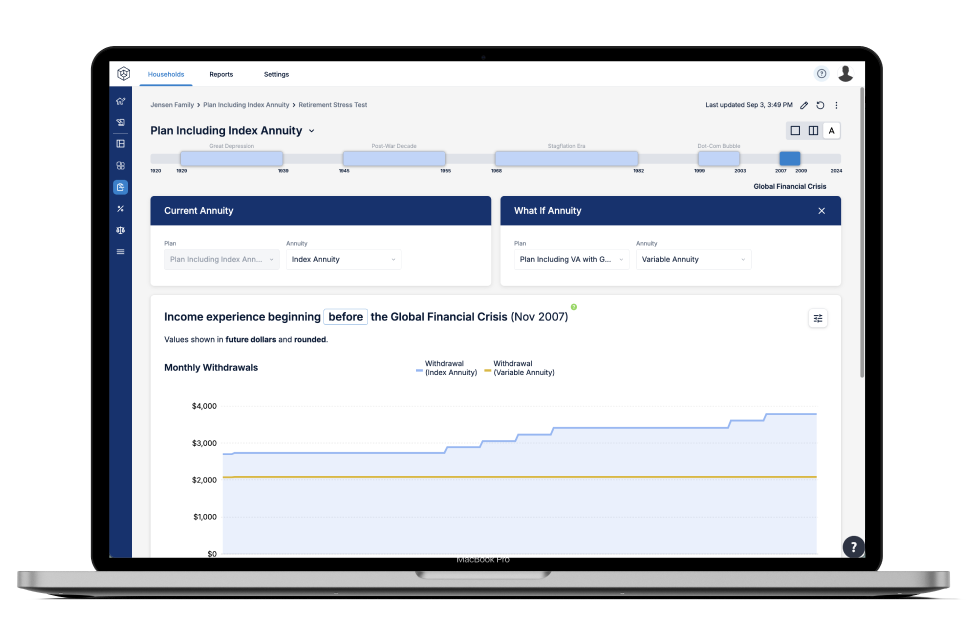

Deciding between annuity options can be tough. Income Lab helps you see how different annuities stack up through the same return scenarios, all on one screen. Income Lab’s powerful annuity comparison tool is unique in the world of annuity retirement planning software and retirement annuity calculators for advisors.

Head-to-head annuity comparison has never been easier or clearer. See how different annuities fare across a range of returns and inflation with cutting-edge analytics and compelling visuals.

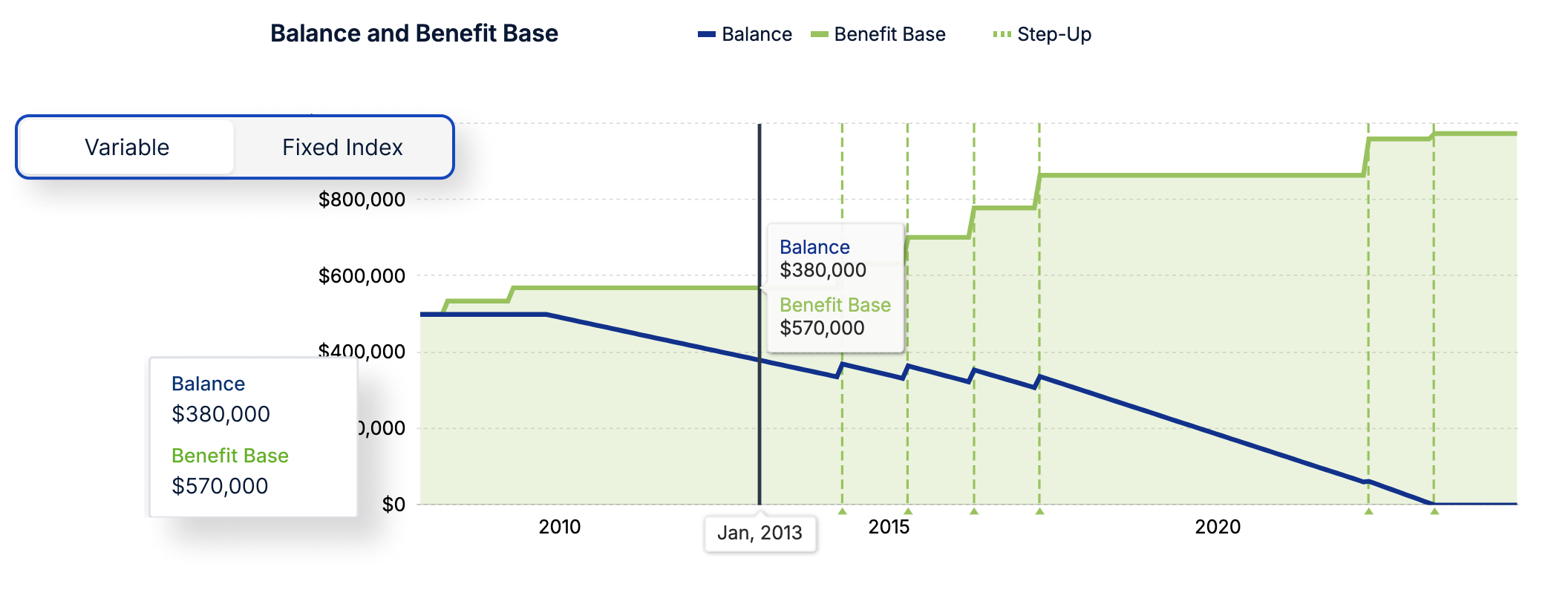

Step-ups, roll-ups, caps, participation rates, benefit bases, and more! The language around annuities can make your head spin. Annuity planning with Income Lab helps you focus on the basic questions clients actually have: How much can I spend? What could change that? What could a change look like?

Trying to decide if an annuity is a good fit can be hard. Income Lab lets you compare a plan with and without an annuity and see how an annuity could affect income, guardrails, and overall portfolio balances in specific market and inflation environments.

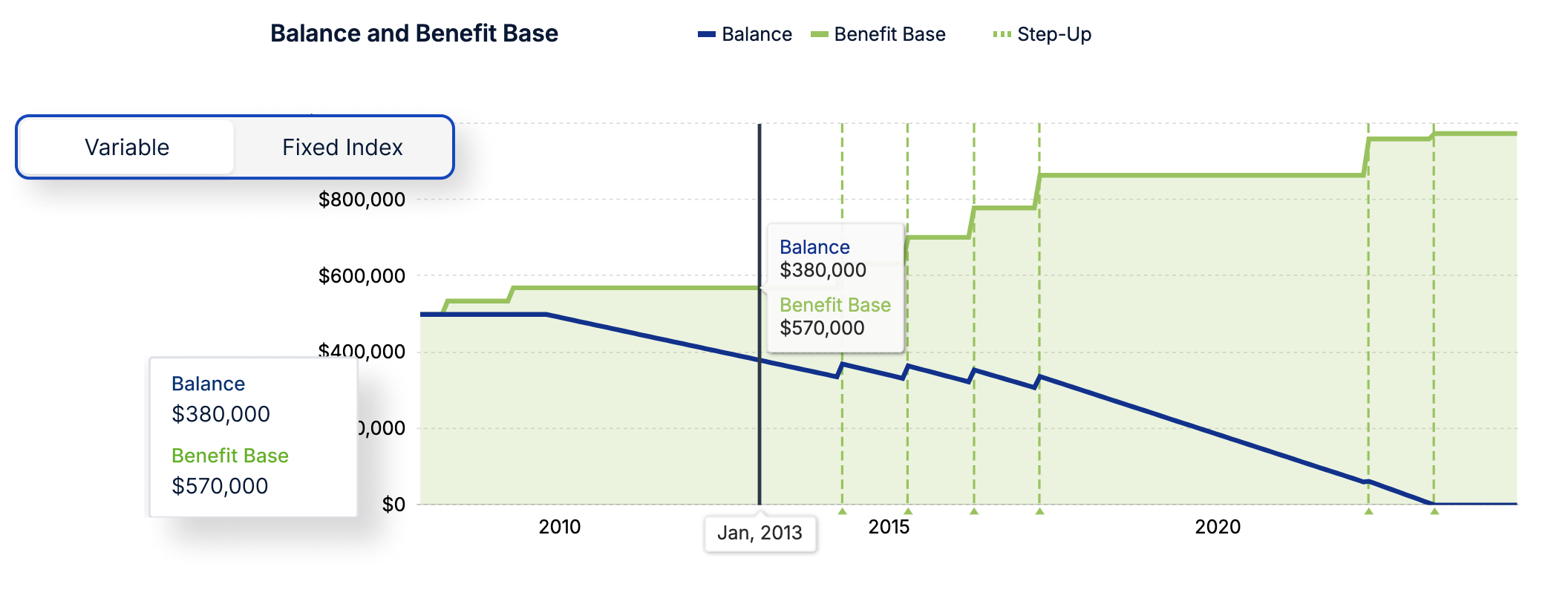

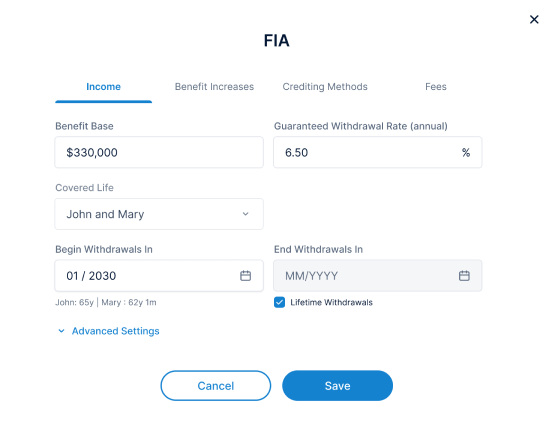

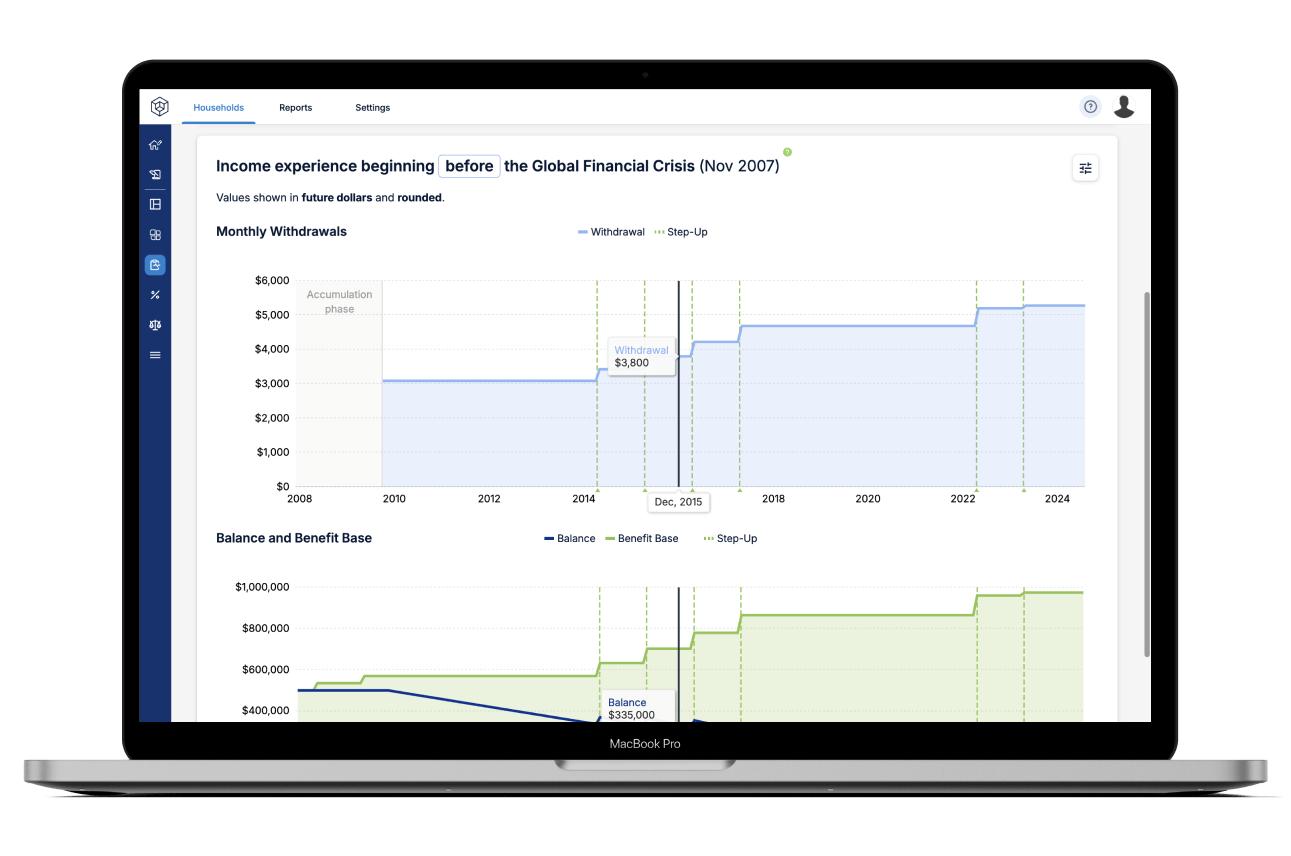

Income Lab lets you show how a specific annuity would react to different return and inflation sequences so you can evaluate how the annuity actually works in terms of balance and income provided. Income Lab's clear illustrations help you understand the annuity and explain it to clients.

Compare Annuities

Compare Annuities

Head-to-head annuity comparison has never been easier or clearer. See how different annuities fare across a range of returns and inflation with cutting-edge analytics and compelling visuals.

Cut Through the Jargon

Cut Through the Jargon

Step-ups, roll-ups, caps, participation rates, benefit bases, and more! The language around annuities can make your head spin. Annuity planning with Income Lab helps you focus on the basic questions clients actually have: How much can I spend? What could change that? What could a change look like?

Evaluate Plans Holistically

Evaluate Plans Holistically

Trying to decide if an annuity is a good fit can be hard. Income Lab lets you compare a plan with and without an annuity and see how an annuity could affect income, guardrails, and overall portfolio balances in specific market and inflation environments.

See How an Annuity Really Works

See How an Annuity Really Works

Income Lab lets you show how a specific annuity would react to different return and inflation sequences so you can evaluate how the annuity actually works in terms of balance and income provided. Income Lab's clear illustrations help you understand the annuity and explain it to clients.

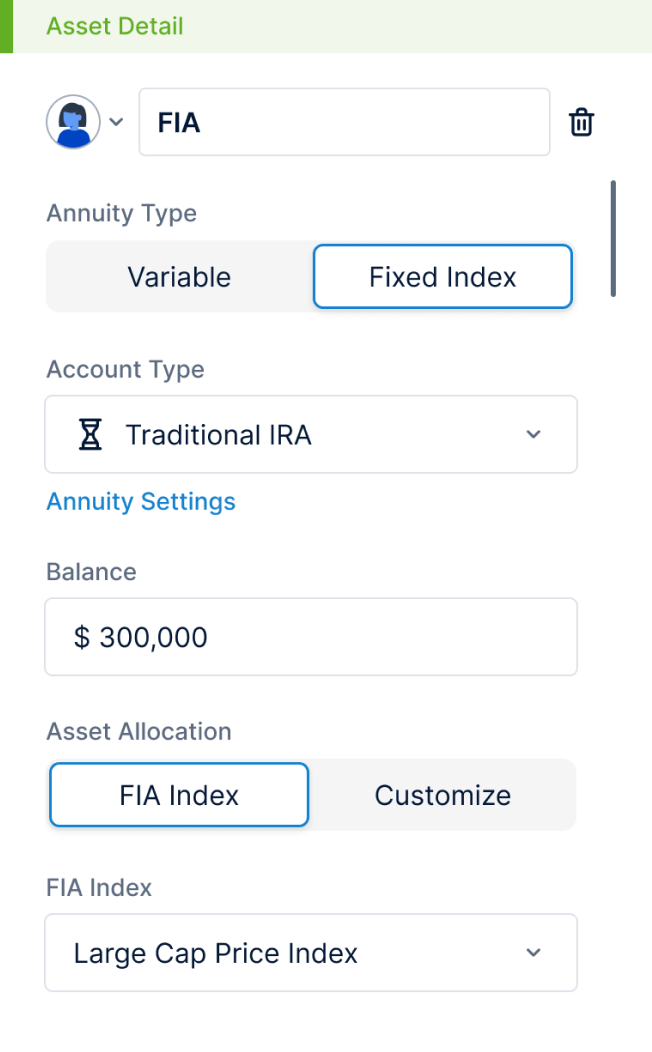

Model a range of FIA designs in your Income Lab plans, including different indexes, caps, participation rates, fixed rates, and living benefit features.

Realistically model VA allocations, living benefit riders, and fees to see how annuities affect your clients' income plans.

See how a traditional immediate or deferred annuity income stream could affect spending and portfolio balance through a plan.

Model caps, spreads, and more, as well as transitions to FIAs with living benefits during the withdrawal phase.