As the calendar year draws to a close, year-end financial planning becomes important for both advisors and their clients. These meetings provide a strategic opportunity to assess financial health, address any gaps, and set the foundation for long-term success. A well-structured review not only ensures portfolios remain aligned with clients’ goals but also strengthens the advisor-client relationship through proactive communication and personalized strategies.

In this guide, we’ll cover topics that should be discussed during these meetings, including tax planning, retirement contributions, estate planning, charitable giving, and insurance reviews.

Following a comprehensive financial planning checklist helps advisors ensure that their clients maximize financial opportunities and feel confident moving into the new year.

Part 1: Pre-Meeting Preparation

Review Client’s Current Financial Situation

The first item that should be on a year-end financial checklist is reviewing the client’s current financial situation. This ensures that all recommendations are based on up-to-date information, and aligned with the client’s evolving goals and circumstances.

Evaluate how the client’s investments are performing relative to their financial objectives. Identify whether portfolios need rebalancing or adjustments to improve diversification, manage risk, or take advantage of market conditions. Review income streams and monthly expenses to ensure that savings goals, retirement plans, and emergency funds remain on track.

Significant life events can have a lasting impact on financial plans. During the meeting, check for updates such as:

- New employment or job loss: Adjust cash flow strategies and retirement contributions accordingly.

- Health issues: Review insurance coverage, healthcare savings plans, or emergency funds.

- New financial goals: Adapt the plan if the client is saving for new goals like education, travel, or property investment.

Addressing these changes early ensures that your year-end financial planning efforts remain responsive and aligned with the client’s evolving needs. This proactive approach builds trust and helps clients feel supported as their circumstances shift.

Gather Key Documents

A smooth and productive financial planning checklist begins with proper documentation. Ensuring all relevant documents are collected and up to date allows advisors to perform a thorough review and offer well-informed recommendations.

Investment statements provide insights into the client’s portfolio performance and asset allocation, helping identify areas that may require rebalancing. Tax documents, such as W-2s, 1099s, or estimated tax payments, are helpful for spotting potential tax-saving strategies before the year ends. Retirement contribution summaries reveal whether clients are maximizing their 401(k) or IRA contributions, offering a chance to make last-minute adjustments. Additionally, reviewing insurance policies ensures adequate coverage for life, health, or disability needs, helping identify any gaps or areas where new policies might be beneficial.

Collecting these documents in advance of a year-end financial planning meeting allows for a more seamless conversation, ensuring that all financial aspects are accurately assessed and no critical areas are overlooked.

Leverage Financial Planning Software

Using financial planning software enhances the precision and effectiveness of a year-end financial checklist, empowering advisors to offer clients better insights and recommendations.

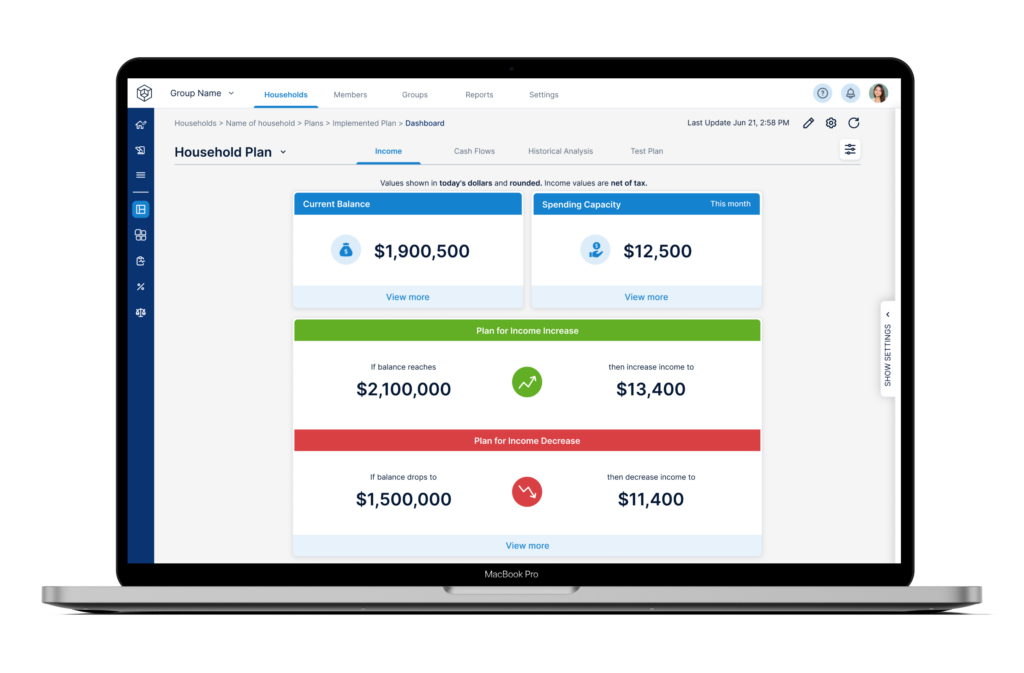

Income Lab’s tools, such as Life Hub and Tax Lab, provide robust support for projecting financial scenarios and exploring multiple outcomes. These platforms allow advisors to simulate various “what-if” scenarios, showing clients the potential impact of different financial decisions.

By utilizing data-driven insights from software like Income Lab, advisors can model outcomes based on changes in income, expenses, market conditions, or tax laws. This approach ensures that recommendations are tailored to the client’s goals and are responsive to evolving circumstances.

Part 2: Agenda Setting for the Meeting

Send Meeting Agenda in Advance

Providing clients with a detailed meeting agenda ahead of time sets the tone for productively going through a financial planning checklist. Sharing a list of topics — such as tax planning, and retirement contributions— in advance helps clients understand the scope of the discussion and prepare accordingly. When clients are engaged from the start, meetings become more focused and collaborative, allowing for deeper discussions and more effective year-end financial planning.

Prioritize Key Issues

Focusing on the most pressing areas ensures that each meeting addresses what matters most to the client’s financial situation. Whether fine-tuning retirement plans or optimizing tax strategies tailoring the agenda to the client’s specific needs leads to more meaningful conversations. Advisors can use the client’s current financial status and goals as a guide, ensuring the discussion remains relevant and actionable. This customized approach not only maximizes the value of the meeting but also helps clients feel understood and supported in achieving their financial objectives.

Encourage Client Participation

Engaging clients actively in the planning process strengthens the advisor-client relationship and ensures the discussion is comprehensive. Asking clients to share updates about any recent life changes, such as a new job, inheritance, or major expense, provides important context for financial adjustments. Encouraging their participation creates a sense of collaboration and ensures that their evolving goals and circumstances are reflected in the plan.

Key Components of the Year-End Financial Planning Review

Investment Performance Review

Reviewing the performance of a client’s portfolio is necessary to ensure their investments align with their financial objectives. This process involves evaluating how well each asset has performed over the past year in relation to the client’s long-term goals and risk tolerance. If certain investments have drifted from their intended allocations due to market fluctuations, it may be necessary to suggest rebalancing. Adjustments help maintain the portfolio’s strategic focus, ensuring it continues to align with market conditions and the client’s evolving financial priorities.

Tax Planning and Optimization

A thorough tax planning review ensures clients take advantage of strategies that can minimize their tax burden. This part of a financial advisor checklist involves discussing opportunities for tax-loss harvesting, where underperforming investments are sold to offset gains and reduce taxable income. It’s also important to evaluate potential changes in tax brackets that might impact the client’s financial situation, allowing for timely adjustments.

Advisors should also ensure clients are maximizing retirement contributions to tax-advantaged accounts like 401(k)s and IRAs, helping them secure both immediate tax benefits and long-term financial growth.

Retirement Planning

As part of a year-end financial checklist, assessing clients’ progress toward their retirement goals is key. This involves examining whether they are on track to meet their desired retirement lifestyle and making adjustments to contributions if necessary. Advisors should discuss any changes in clients’ circumstances that might affect their retirement plans, such as shifts in income or expenses.

Income Lab’s software can be invaluable in this process, allowing advisors to model various scenarios based on current market conditions and the client’s retirement timeline. These insights help ensure that clients make informed decisions about their contributions.

Estate Planning Review

Conducting a thorough review of the client’s estate planning documents is another important part of the year-end financial planning process. This includes updating wills, trusts, and beneficiary designations as necessary to reflect any significant life changes that may have occurred throughout the year, such as marriage, divorce, or the birth of a child.

Advisors should also discuss potential estate tax strategies that may be relevant, particularly if there have been changes in tax laws or the client’s financial situation.

Charitable Giving

Incorporating charitable giving into year-end financial planning offers clients a chance to support causes they care about while optimizing their tax situation. Advisors should explore tax-efficient charitable contributions, such as donor-advised funds, which allow clients to make a single contribution and then allocate funds to various charities over time. This strategy can provide immediate tax benefits while enabling clients to engage in thoughtful philanthropy.

Additionally, discussions should focus on maximizing the tax advantages of charitable giving, including strategies like bunching deductions or utilizing appreciated assets for donations. Thoughtfully integrating charitable giving into client’s financial plans enables them to enhance their tax efficiency while making a positive impact on their communities.

Insurance and Risk Management

Advisors should evaluate clients’ life, health, and disability insurance coverage to ensure there are no gaps that could expose them to unnecessary risks. This assessment should include a comprehensive analysis of current policies, determining whether coverage levels align with the client’s needs and financial goals.

This is also an opportunity to identify any additional risk management strategies that could benefit the client, which might involve discussing options for increasing coverage, exploring long-term care insurance, or implementing strategies to mitigate potential financial losses.

Action Items and Follow-Up

Provide a Summary of the Meeting

After successfully going through a financial planning checklist, advisors should provide clients with a clear written summary of the key takeaways and action items discussed. This summary should encapsulate the main points covered, including any decisions made regarding investments, tax strategies, retirement planning, and insurance reviews.

It’s important that clients understand the next steps they need to take based on the discussions. This might include deadlines for certain actions, such as updating estate documents or increasing retirement contributions.

Set Goals and Deadlines

Setting clear, actionable goals for the new year is a key step in the year-end financial planning process. Advisors should work with clients to establish specific objectives, such as adjusting retirement contributions, updating estate planning documents, or implementing new tax strategies.

These goals should be designed to be measurable and time-bound, allowing both the client and advisor to track progress effectively. For instance, a goal might specify that a client aims to increase their 401(k) contributions by a certain percentage by the end of the first quarter. Clear outlines better position clients to achieve their financial aspirations and understand the importance of staying on track throughout the year.

Schedule a Follow-Up

To ensure that goals are met and to maintain an ongoing dialogue, it’s smart to schedule a follow-up meeting early in the year. This check-in provides an opportunity to review the client’s progress toward the goals established during the year-end meeting and to address any lingering questions or concerns.

Utilizing Income Lab can enhance this process by tracking and adjusting goals as needed, based on real-time data and market conditions. This proactive approach not only helps clients stay focused on their financial objectives but also reinforces the advisor’s role as a supportive partner in their financial journey.

Leveraging Technology and Tools

Automating and Tracking Client Progress

Utilizing Income Lab’s retirement and tax planning software allows financial advisors to automate workflows and track client progress efficiently throughout the year. By integrating digital tools into their practices, advisors can streamline processes that traditionally consume significant time and resources. This automation not only enhances productivity but also provides advisors with real-time insights into their clients’ financial health.

Incorporating Planning Tools

Likewise, taking advantage of planning tools can help advisors better manage and update estate planning documents, ensuring that clients’ wills, trusts, and beneficiary designations are current and reflective of their wishes. These tools also allow for easy tracking of changes in client circumstances, which can prompt necessary adjustments to estate plans.

With real-time data at their fingertips, advisors can also quickly assess the implications of new regulations and recommend appropriate strategies, such as tax-loss harvesting or changes in asset allocation.

Client Communication Best Practices

Building Rapport and Trust During the Meeting

Establishing a strong rapport and trust with clients during financial planning meetings is what helps create lasting relationships and ensure effective communication. To create an open and inviting atmosphere, advisors should prioritize active listening, showing genuine interest in clients’ concerns and aspirations.

Effective communication is key when discussing complex financial topics. Advisors should strive to present information in a clear and relatable manner, using simple language and avoiding jargon. Visual aids, such as charts and graphs, can be particularly helpful in illustrating intricate concepts.

Advisors should also encourage questions throughout the discussion, which can promote a collaborative environment where clients feel comfortable voicing their thoughts and concerns, ultimately strengthening the advisor-client relationship.

Ensuring Clients Feel Informed and Confident

To ensure clients feel informed and confident in their financial decisions, advisors should provide clear, actionable steps that empower them to take control of their financial futures. This involves breaking down complex strategies into manageable tasks that clients can implement throughout the year.

It’s also important for advisors to ensure that all recommendations are clearly explained and supported by data from tools like Income Lab. Providing clients with tangible evidence and projections can reinforce the rationale behind financial decisions, making them feel more secure in their choices.

Conclusion

Year-end financial planning meetings offer an excellent opportunity to evaluate and enhance clients’ financial well-being. These meetings not only strengthen the trust between advisors and clients but also provide a systematic framework for addressing areas like tax planning, retirement contributions, estate planning, and beyond. To maximize the impact of your year-end planning, consider leveraging Income Lab’s retirement planning software. Our innovative tools are designed to elevate client satisfaction and outcomes while creating stronger and more resilient financial relationships.