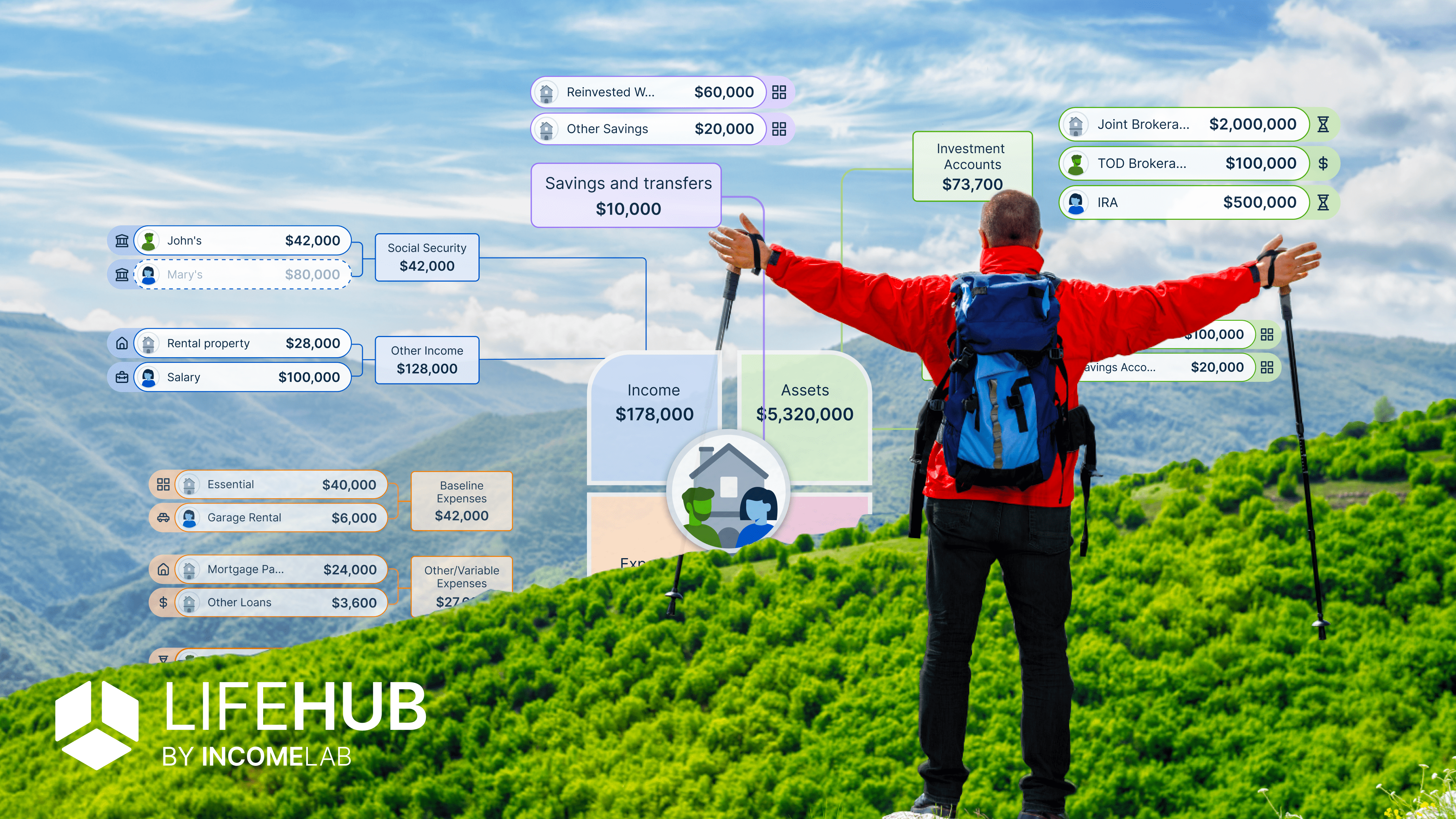

The interactive financial planning tool is easy to use, easy to

explain, and easy to understand.

DENVER, January 23, 2024 – Income Laboratory, Inc. (Income Lab), maker of award-winning retirement income planning software, today announced the launch of Life Hub, as a stand-alone app for financial advisors and their clients. Life Hub is a financial planning tool that helps advisors take their clients to and through retirement in a clear and interactive way. The announcement comes on the heels of Income Lab’s recent brand refresh and aligns with their mission of revolutionizing how people navigate retirement so they can live with confidence. The goal of this launch is to make planning clearer and more accessible, not only for advisors but more importantly for the clients they serve.

“We believe every person deserves a Life Hub plan. Advisors tell us that Life Hub helps them clear away the clutter from planning and make it clear how clients can make their financial lives and goals happen,” said Johnny Poulsen, co-founder and CEO of Income Lab. “Advisors are faced with changing client needs, and expectations on what planning should look like are trending to be more visual, interactive, and conversational. Clients want to be a part of the process and interact with their plan.”

Life Hub is a game changer for financial advisors who are looking to drive clearer conversations with clients and build stronger rapport. Advisors can build, present, and update retirement plans for their clients and prospects in minutes, all on one screen. Plan construction and presentations are visual, and advisors can customize exactly which pieces of the plan to show so they can guide fruitful conversations

with each client.

“What I like most about Life Hub is how it conveys a person’s total life (not just financial) picture and connects it with some of the most creative analytical tools in the fintech marketplace,” said Bob Veres, Editor & Publisher of Inside Information.

Key features of Life Hub include:

● Visual financial planning that clients can understand

● Withdrawal sourcing down to the account level

● Timeline with Milestones

● Social Security Planner

● Multiple tax strategies, including Roth conversion planning

● Longevity planning

● Scenario planning and comparisons

● “Quick create” option for fast plan builds

● Client portal

● Custom 1-page plan reporting

● “Quick create” option for fast plan builds

● Integrations and account aggregation

● Knowledge Base, self-paced onboard, and live support

Life Hub is priced at $49 per month or $399 per year, truly making it accessible for advisors to add to their tech stack. Advisors can try Life Hub free for 14 days, after which standard pricing applies. Because Life Hub is part of the Income Lab platform, users can easily add other Income Lab capabilities, such as tax-smart distribution planning and adjustment-based retirement management to their clients’ plans as their needs grow or change.

“We’re thrilled to make Life Hub accessible to many more advisors and clients with this launch,” said Justin Fitzpatrick, co-founder and CIO of Income Lab. “We know that engaging with clients this way can lead to that ‘ah ha!’ moment, where clients really understand how it all fits together.”

To learn more about Life Hub you can visit Income Lab’s website, or join an upcoming webinar on February 27, 2024, at 11 am ET to hear from advisors how Life Hub has helped them cultivate deeper relationships with their clients and grow their businesses.

About Income Lab

Income Lab provides financial advisors with cutting-edge software for ongoing retirement income management and client engagement. Advisors use Income Lab to give clients targeted, customized advice about how much they can spend, when and how to adjust spending for evolving economic and market conditions, and how to optimize distribution plans for tax efficiency. Income Lab software was named “Best in Show” at the 2022 & 2023 XYPN Advisor Tech Expos, was the “Highest-Rated Retirement Distribution Planning Tool” in the 2023 T3/Inside Information Advisor Software Survey, and was named a “Stand-Out in Retirement Distribution Planning” and rated highest in satisfaction and value by the “Kitces.com Report: The Technology that Independent Financial Advisors Actually Use (And Like)”. For more information, please visit Income Lab.