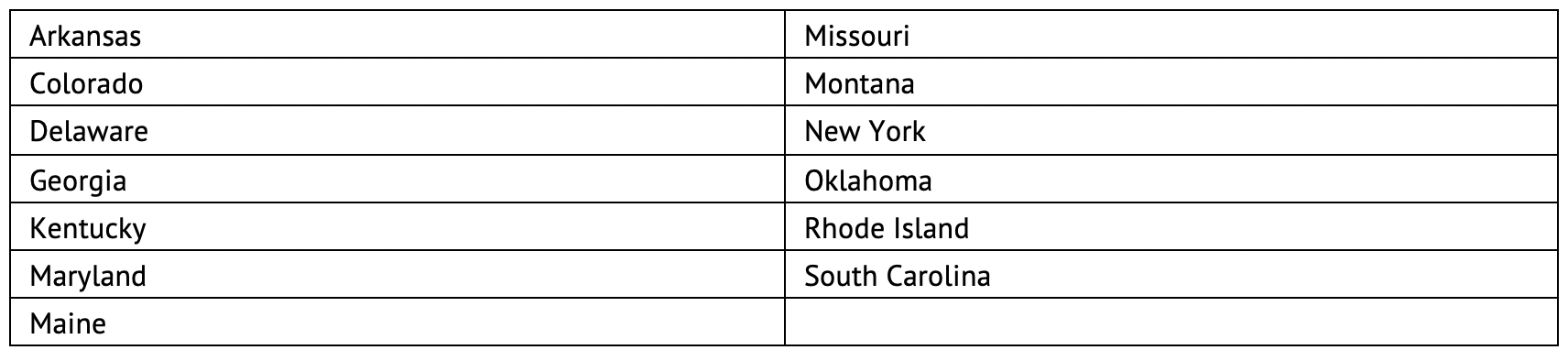

Smart retirement planning includes taking advantage of a maze of complex – but ultimately favorable – state tax policies. Almost every state has its own policies when it comes to retirement income. By understanding these policies and implementing tax-smart strategies, you can significantly reduce retirees’ annual state tax bills. Many states treat retirement income differently than other income and exclude some level of Social Security and/or pension income1 from taxation.2 These exclusions, along with a range of other tax policies that have a direct impact on retirees, can make even supposedly high-tax states like California and Hawaii into low- or zero-tax states. But in the following thirteen states, getting the most from these tax exclusions requires careful planning both before and during retirement.

(For a more thorough guide to state income taxes in retirement, see our State Income Tax Guide.)

(For a more thorough guide to state income taxes in retirement, see our State Income Tax Guide.)

Splitting Taxable Retirement Income Between Spouses

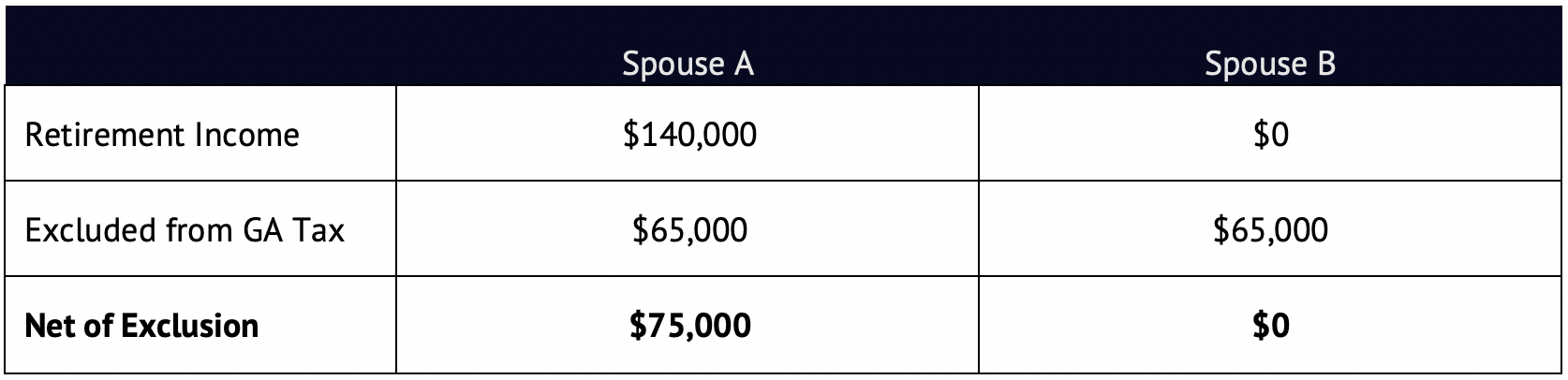

The states included in the list above apply retirement income exemptions on a per-spouse basis, not as a combined exemption for the household. This means that in order to access up to double the per-person exclusion each spouse needs to have their own retirement income. For example, in Georgia, spouses who are both age 65+ could exclude a combined $130,000 in retirement income. However, each spouse can only exclude up to $65,000 of their own retirement income. If one spouse has, for example, $140,000 in income and the other spouse has none, only $65,000 could be excluded from state taxation.

Scenario 1A – Exclusion Not Maximized

Scenario 1B – Exclusion Maximized

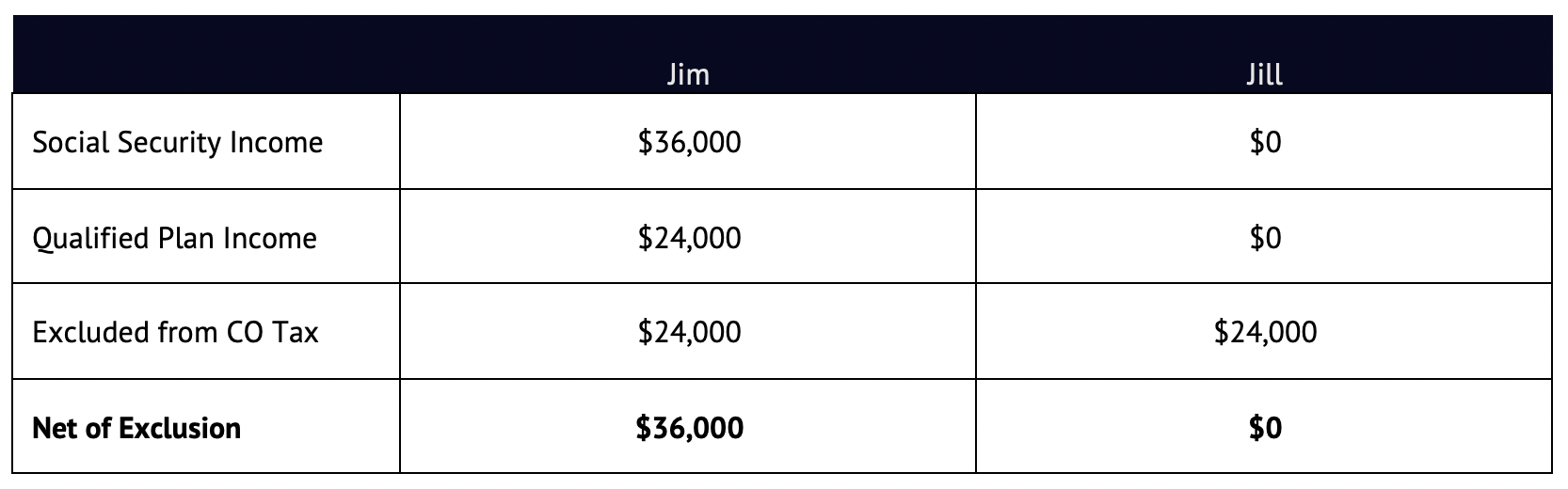

Social Security Matters

In Colorado, Maryland and Maine, Social Security income reduces otherwise available retirement income exclusions. Of course, it is generally not feasible to plan proactively for a couple to qualify for similar Social Security benefits and therefore “split” Social Security income evenly between spouses). But it is still important to adjust distributions in these states to maximize total exclusions. This may be especially true during years when one spouse takes Social Security and the other does not, or if one spouse’s Social Security income is substantially lower than the other’s. In such years, it may make sense for the spouse with lower Social Security income to take more in qualified plan distributions. Taking this action can even out total retirement income between the spouses up to the exclusion amount available in their state.

For example, imagine Jim and Jill live in Colorado. Jim is 67 and receives $36,000/year in Social Security while his wife Jill is 62 and is planning to delay taking Social Security until age 70. If the couple wants a total of $60,000 in pre-tax income, it may make sense to have Jill take $24,000 from her qualified plans, since this would maximize their Colorado tax exclusions and result in $12,000 in Colorado-taxable income for the couple. If instead Jim took $24,000 from his own qualified accounts, the couple would have $36,000 in income taxable at the state level.

Scenario 2A – Exclusion Not Maximized

Scenario 2B – Exclusion Maximized

Other Considerations

Of course, as with so many planning strategies, other considerations may outweigh this state tax strategy. For example, income splitting could be less attractive if one spouse has particularly large qualified accounts. Large qualified balances could result in high required minimum distributions later in life, which could push the couple into very high tax brackets. In this case, it may make more sense to take distributions in early years when they can be taxed at lower rates, even if these distributions would also be taxable at the state level.

State-by-State Guide

The details of retirement income exclusions can be quite complex. Here we detail some of the rules that apply in these “income splitting” states.

- Arkansas: Up to $6,000/person in taxable pension and qualified plan income is excluded from taxation. Military retirement income is also excluded from taxation, but taxpayers cannot both exclude military retirement income and claim the $6,000 pension exclusion. Pension/IRA distributions for reasons other than retirement, death, or disability (e.g., for medical expenses, higher education, or a first-time home purchase) do not qualify for the exclusion. Lump-sum distributions are not eligible.

- Colorado: Exclude from state taxation up to $24,000/person (age 65+) or $20,000/person (age 55-64) any Federally taxable Social Security income and taxable pension/qualified plan income received for retirement, death or disability. (No separate exclusion of Social Security income is available in Colorado.) Amounts subject to pre-mature withdrawal penalties cannot be excluded. Lump-sum distributions are not eligible.

- Delaware: Exclude from state taxation pension and retirement income up to $12,500/person age 60+ or $2,000/person under age 60. Amounts subject to an early withdrawal penalty or amounts received due to death are not excludable. Income from a maximum of one defined benefit pension can be excluded per person, along with other eligible retirement income. Eligible retirement income includes taxable distributions from IRAs and qualified plans as well as rental income and taxable dividends, capital gains, and interest from investments not held in retirement accounts.

- Georgia: Allows exclusion of “retirement income” up to $35,000/person age 62-64 or $65,000/person age 65+. Retirement income includes up to $4,000/person of earned income and most other kinds of income (pensions, qualified plans, non-qualified investment income, rental income, etc.).

- Kentucky: Exclude up to $31,110/person in pension and qualified retirement plan income.

- Maryland: Exclude up to $31,000/person in pension and qualified retirement plan income. Maryland also excludes Social Security income from taxation. However, the $31,000/person retirement income exclusion is reduced dollar-for-dollar by an individual’s total Social Security income, whether or not it is taxable at the Federal level. Therefore, if a taxpayer has $31,000 or more in Social Security income, no additional exclusions are available.

- Maine: Exclude up to $10,000 per person in pension and qualified retirement plan income. Maine also excludes Social Security income from taxation. However, the $10,000/person retirement income exclusion is reduced dollar-for-dollar by an individual’s total Social Security income, whether or not it is taxable at the Federal level. Therefore, if a taxpayer has $10,000 or more in Social Security income, no additional exclusions are available.

- Missouri: Different exclusion rules apply to public pension income (generally, pensions from government sources) and private pension income. For private pension and retirement plan income, up to $6,000/person can be excluded, but this exclusion is reduced at certain income thresholds.

- Montana: Exclude up to $4,300/person in pension and retirement plan income. This exclusion amount is reduced or eliminated above certain income thresholds.

- New York: Exclude up to $20,000/person age 59½+ in pension and taxable retirement plan income.

- Oklahoma: Exclude up to $10,000/person in pension and taxable retirement plan income.

- Rhode Island: Up to $15,000/person in pension and retirement plan income can be excluded by individuals of full retirement age. This exclusion is subject to phase-out above certain income thresholds. IRA distributions are not eligible for this exclusion.

- South Carolina: Up to $3,000/person under age 65 or $10,000/person age 65+ of qualified plan income can be excluded. Amounts subject to an early withdrawal penalty are not eligible for this exclusion.

1. Though state rules differ slightly, pension income typically includes funds withdrawn from IRAs, retirement plans like 401(k)s and 403(b)s as well as defined benefit plan income.

2. All tax commentary is intended for general education. For information on your situation, please consult a tax professional. All information discussed here is based on the 2019 tax year. State tax policies are subject to change.