Back to List

Today, Kitces published a great article co-authored by Derek Tharp and Income Lab co-founder, Justin Fitzpatrick.

Here are a few of the main points:

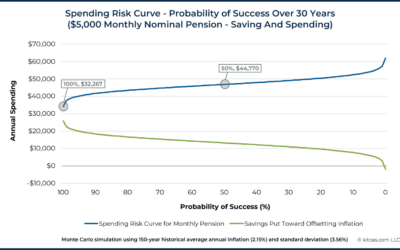

- “Spending Risk Curves” can be very useful for an advisor to gain a higher-level understanding of a client’s financial options by visually illustrating the trade-offs between a client’s spending choices and risk in retirement.

- When clients can actually visualize how their plans translate into real dollars and how guardrails can safeguard against overspending (and allow for more spending when the portfolio does well) – instead of trying to decipher abstract probability-of-success or Spending Risk Curves – they will be better equipped to actually accept and follow their plans!