Back to List

Kitces published a great article authored by Derek Tharp, Senior Advisor to Income Lab. In the article Derek explains how most Monte Carlo tools gamify the retirement income decision in a way that leads to being excessively conservative. Risk-based guardrails are a far better way to harness the power of Monte Carlo simulation in a way that is more useful for retirees.

Here are a few of the main points:

- While Monte Carlo incentivizes clients to achieve higher and higher probabilities of success, actually working to achieve the ‘best’ success probability of 100% may push clients toward outcomes that are out of line with their goals for spending, giving, and leaving behind assets during their lifetimes.

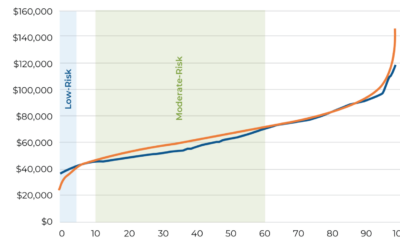

- Advisors can reframe how outcomes are measured by shifting the focus from an acceptable probability of success to a more dynamic concept of probability of adjustment

- Advisors can help harness the gamification power of Monte Carlo in a way that is better aligned with the client’s goals by framing the range of desirable outcomes and reorienting the conversation away from probability of success and toward the client’s concrete actions.